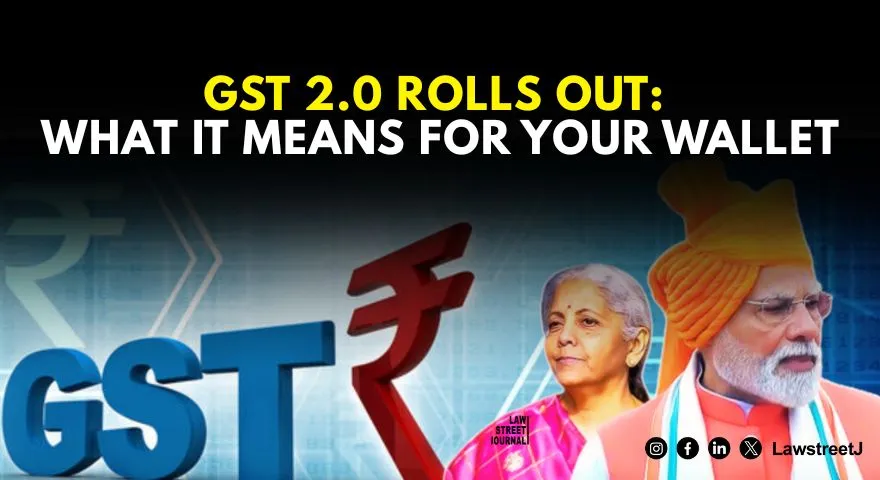

New Delhi: India has taken a decisive leap in its taxation framework with the launch of GST 2.0, a sweeping reform designed to simplify the indirect tax regime, reduce costs for citizens, and fuel economic growth. Announced by the Prime Minister as a “Bachat Utsav” (Festival of Savings), the new system is expected to generate annual savings of nearly ₹2.5 lakh crore, combining gains from revised GST slabs and recent income tax exemptions.

At the core of the reform is a reduction of the existing four-slab structure (5%, 12%, 18%, 28%) into a simpler two-rate framework (5% and 18%), marking the biggest reset of India’s taxation landscape since GST’s inception in 2017.

What It Means for Consumers: Relief at Checkout

The immediate impact is visible on daily bills and receipts. Decisions from the 56th GST Council meeting confirm tax cuts on more than 375 items across sectors:

- Groceries and Staples: Dairy products including butter, ghee, and paneer now attract 5% GST instead of 12%. Amul has already reduced retail prices—100g butter at ₹58 (down from ₹62) and 200g paneer at ₹95 (down from ₹99).

- Daily Essentials: Shampoos, soaps, biscuits, and chocolates have moved to the 5% bracket, cutting household expenses across the board.

- Automobiles: Two-wheelers under 350cc and small cars now fall under 18% GST instead of 28%. Maruti Suzuki has reduced Swift prices by up to ₹84,600, with industry-wide cuts expected to follow.

- Housing and Construction: Cement, bricks, and granite slabs now attract lower rates, paving the way for affordable housing and reduced construction costs.

- Healthcare: Thirty life-saving drugs and diagnostic kits are tax-free. Health and life insurance premiums are also GST-exempt, making coverage more affordable.

The Bigger Systemic Reset

Beyond consumer relief, GST 2.0 tackles long-standing structural issues:

- Simplified Compliance: Fewer slabs reduce classification disputes and ease paperwork for businesses, particularly MSMEs.

- Inverted Duty Correction: Inputs in textiles and fertilizers now taxed at 5%, easing blocked capital in input tax credit refunds.

- Revenue Balancing: Luxury goods and “sin” items—such as pan masala, aerated beverages, casinos, and online gaming—fall under a special 40% slab, maintaining fiscal equilibrium.

- Dispute Resolution: The long-awaited Goods and Services Tax Appellate Tribunal (GSTAT) is expected to be functional by December 2025 to streamline litigation and reduce backlogs.

Why MSMEs Stand to Gain

Micro, Small, and Medium Enterprises—the backbone of India’s economy—are projected to benefit significantly. With input costs rationalised and compliance simplified, MSMEs gain breathing room for innovation, expansion, and job creation. The reforms are expected to enhance liquidity, allowing small businesses to compete more effectively both domestically and globally.

Economic Outlook: Inclusive Growth

While experts at FICCI caution that government revenues may see a temporary dip, the reforms are anticipated to stimulate consumption and boost compliance, triggering long-term growth. Lower prices are expected to raise demand, spur private investment, and create a virtuous cycle for manufacturing and services.

The reforms are closely aligned with the vision of “Aatmanirbhar Bharat” and “Viksit Bharat 2047”—aims that seek to position India as a self-reliant, developed nation by its centenary of independence.

![Gujarat HC Directs Revocation Of GST Registration Cancellation After Tax Deposit Verification [Read Order]](/secure/uploads/2025/11/lj_9008_Gujarat_HC_Directs.webp)