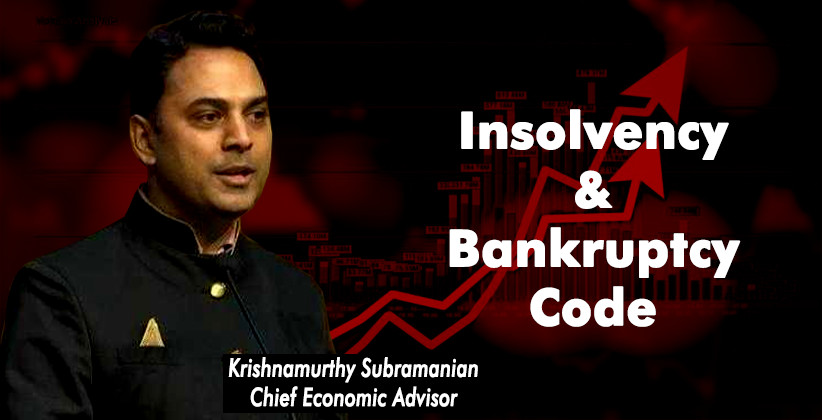

The Chief Economic Advisor, Krishnamurthy Subramanian on Wednesday (14th October 2020) expressed that Indias four-year-old Insolvency and Bankruptcy Code, which has been amended five times since its enforcement, has scope for further improvements.

Given the stress that had built up in the financial sector before we entered the crisis, we neither will nor have to take care of some stress that will inevitably happen because of COVID-19. The eco-system of creative destruction is a very important part of any economy, he said.

RBI (Reserve Bank of India) estimates that gross bad loans may rise from 8.5% in March 2020 to anywhere between 12.5 to 14.4% by March 2021 due to COVID-19 induced stress.

CEA stressed that assets are important components of a market economy and it is crucial to focus on various stakeholders that enable a process of creative destruction.

Speaking at a FICCI webinar on Investment Opportunities in Stressed Assets in India, Subramanian further said that the IBC is an evolving process and there is still scope for making it far more efficient. He underlined that corporate India needs to recognize and respect the equity contract.

To ensure a more flourishing market for distressed assets market, Subramanian said there was a need to focus on incentives for banks, especially public sector banks, along with establishing a market for price discovery of stressed assets.

Sudhaker Shukla, a whole-time member of the Insolvency and Bankruptcy Board of India (IBBI), during the event, said that the board was developing a platform for stressed assets, which would eventually have an auction platform as well. Shukla said investors can easily find all information about the investment potential through this platform.

Shukla claimed that recoveries under IBC had improved from 2 cents to a dollar to 71 cents to a dollar and the average time taken for resolution under the code had come down from 4.5 to 3 years to 1.6 years over the past three years.