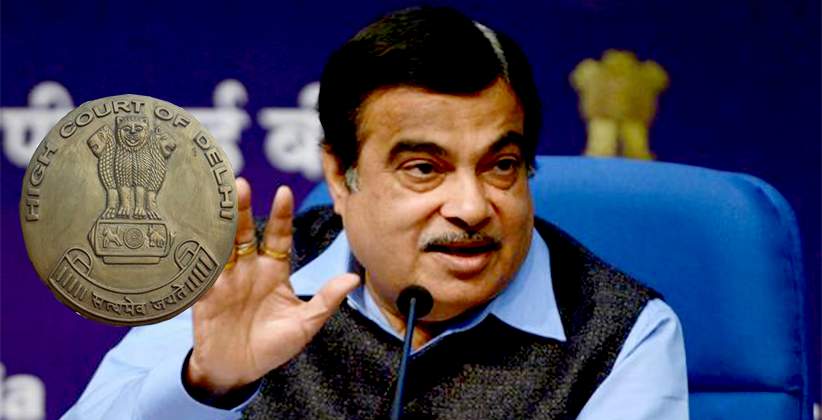

On March 3, 2020 Delhi High Court bench comprising Chief Justice D. N. Patel and Justice C. Hari Shankar directed Union Ministry of Road Transport, Nitin Gadkari to respond to the Public Interest Litigation (PIL) filed by Aam Aadmi Party (AAP) leader Deepak Bajpai and a retired bureaucrat Narendar B. Singh and listed the matter for May 4, 2020.

In the plea, advocate Bhakti Pasrija Sethi and Moksh Pasrija, representing the petitioners, have drawn the attention of the Delhi High Court on the rules regarding re-registration of motor vehicles in the country upon transfer to another state and the inconvenience faced by the vehicle owners in getting the refund of the hefty one-time road tax paid by them in one state upon transfer of a vehicle to another state.

"At the time of registration of a motor vehicle in any state in India, the vehicle owner has to pay one-time road tax for the same," the plea said.

The Motor Vehicles Act, 1988 was passed in the year 1988 by Parliament and regulates almost all the aspects of road transport vehicles.

As per Section 47 of the Motor Vehicles Act, 1988, the vehicle owner has to seek a new registration mark for motor vehicles under new Transport Authority in case the vehicle is transferred to a new state and kept for more than 12 months, the petitioners said: "This entails payment of one-time road tax again to the new state irrespective of the fact that the vehicle owner has already paid one-time road tax in the earlier state."

"The procedure of seeking a refund of one-time road tax already paid in the previous state is very cumbersome and crude in India, which makes it practically impossible for a vehicle owner to get the refund and he ends up paying double taxes," the petitioners stated in the plea.

They further added: "For seeking refund of one-time road tax from the previous state, a vehicle owner has to first pay one-time road tax in new state, and then he has to come back to the authorities in the previous state and apply for the refund by annexing documents/proof of payment in new state and then pursue the matter."

The petitioners have stated that the Central government has not devised an online mechanism of payment and refund of one-time road tax also and this complicates the things further.

"Most of the times it involves multiple visits and it is practically impossible and financially draining for a vehicle owner to visit the previous state. Resultantly the one-time tax paid in the previous state never gets refunded to him and this is double taxation, which is even otherwise unconstitutional and unjustified as no person should be taxed twice for the same liability," the petitioner said.

Author Satwik Sharma